Expenses and liabilities are not understated in the books of accounting. Concept of Accounting and Principles of Accounting.

Prudence Concept Ceopedia Management Online

Prudentia is an allegorical female personification of the virtue.

. Double -entry book keeping principles including the maintenance of accounting records a Identify and explain the function of the main data sources in an accounting systemK. This aspect of the materiality concept is more noticeable when comparing companies that vary in size ie a large company vis-à-vis a small company. This accounting concept promotes prudence in accounting.

It states that profit should not be included until it is realized. Financial information might be of material importance to one company but stand immaterial to another company. Instead what you are striving for is to record transactions that reflect a realistic assessment of the probability of occurrence.

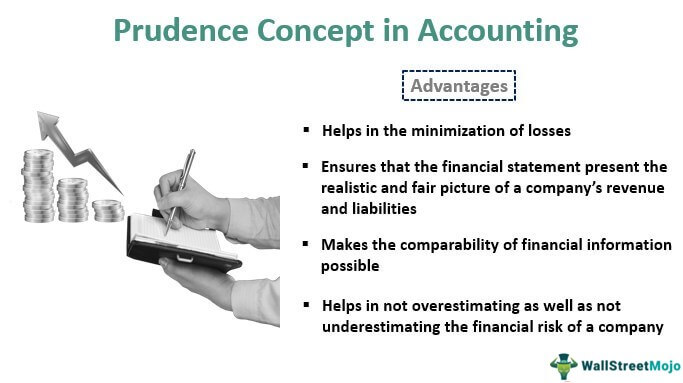

Eg the Prudence concept Prudence Concept Prudence Concept or Conservatism principle is a key accounting principle that makes sure that assets and income are not overstated and provision is made for all known expenses and losses whether the amount is known for certain or just an estimation ie. Internal and External users of Accounting information and their needs. The items that have very little or no impact on a users decision are termed as immaterial or insignificant items.

In particular is considered wise to book an income only when it is realized. Accounting as a business practice the purpose of Accounting. Prudentia contracted from providentia meaning seeing ahead sagacity is the ability to govern and discipline oneself by the use of reason.

A similar cost may be. PDF On Jan 1 2016 Lasse Oulasvirta published Accounting Principles Find read and cite all the research you need on ResearchGate. Common accounting periods include monthly quarterly and annually.

Accounting conceptsK Materiality ii Substance over form iii Going concern v Accruals vi Prudence Consistency C The use of double-entry and accounting systems 1. Alongside this expenses should be booked as soon as a reasonable. Types of business organizations Sole-Traders Partnerships Corporations Limited Liability companies Cooperatives Non-Profit Organizations.

The concept of the accounting period is an important one for financial statements. Accounting Entity Separate Entity Concept. Read this article to learn about the principles of accounting.

The materiality concept of accounting stats that all material items must be properly reported in financial statementsAn item is considered material if its inclusion or omission significantly impacts the decision of the users of financial statements. However losses even those not realized but with the remote possibility of occurring should be included in the financial statements. Keeping this in view.

Summarizes financial results for an. So all losses are recognized those that have occurred or. It means that for the purposes of accounting the business and its owners are to be treated as two separate entities.

It is classically considered to be a virtue and in particular one of the four Cardinal virtues which are with the three theological virtues part of the seven virtues. Prudence concept of accounting states that an entity must not overestimate its revenues assets and profits besides this it must not underestimate its liabilities losses and expenses. It is further assumed that business has its own identity distinct from the owners creditors debtors managers and others.

An accounting period is the interval of time during which accounting activities are measured. Prudence concept is a very fundamental concept of accounting that increases the trustworthiness of the figures that are reported in the financial statements of a business. 221 Business Entity Concept The concept of business entity assumes that business has a distinct and separate entity from its owners.

The concept of materiality in accounting is subjective relative to size and importance. According to this principle business is treated as an entity which is separate and distinct from its owners. The four most important financial statements in accounting are.

The prudence principle of accounting also known as the conservatism principle states that a business should exercise a good degree of caution when booking incomes and expenses. Thus if you were to create a continuum with optimism on one end. The prudence concept does not quite go so far as to force you to record the absolute least favorable position perhaps that would be entitled the pessimism concept.

Prudence Concept In Accounting Overview Guide

Prudence Of Concept Why Is Prudence Important In Accounting

0 Comments